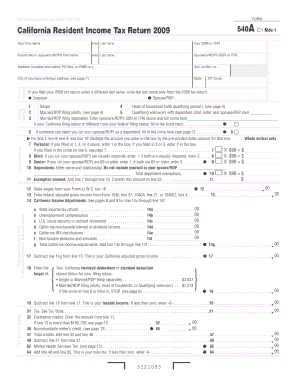

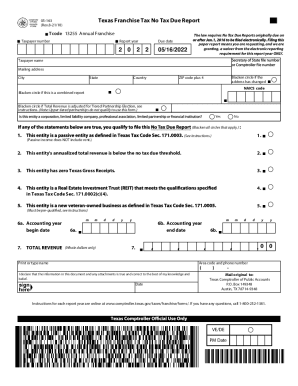

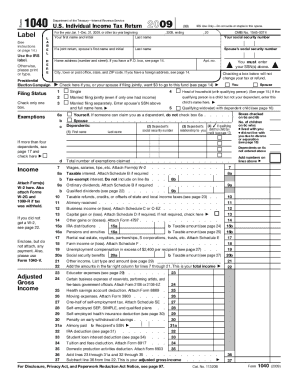

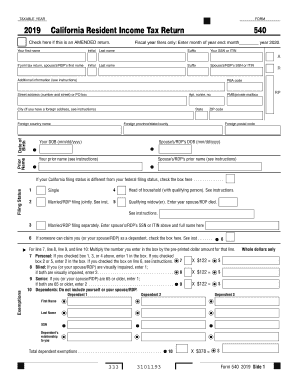

CA FTB 540A 2012-2025 free printable template

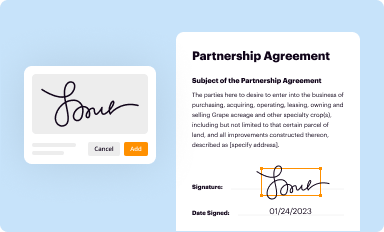

Get, Create, Make and Sign ca state income tax form

How to edit resident income return online

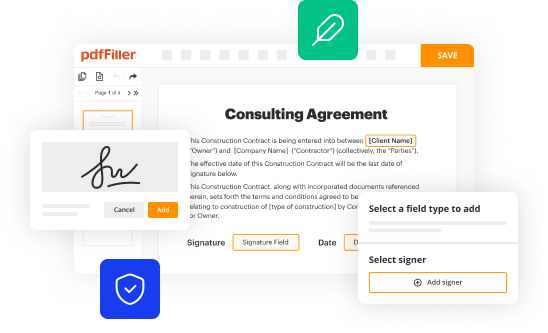

Uncompromising security for your PDF editing and eSignature needs

CA FTB 540A Form Versions

How to fill out 540a form

How to fill out CA FTB 540A

Who needs CA FTB 540A?

Video instructions and help with filling out and completing california state income tax

Instructions and Help about ftb

Welcome to another front a net restoration really this is part two, but part one got pretty long-winded with my discussion of what types of capacitors to use and where you can obtain them, so I thought I would break off part two where I'm going to do the meet of the restoration so here is the radio little Emerson 540 a sometimes called an Emerson s I've already pulled the chassis and I removed the built-in internal and how that makes it a little easier to work on over here just your typical built-in loop antenna there's poking around out of the chassis a little first thing that caught my attention was this resistor that's fried and charred and this capacitor it's blown and end out I studied the schematic for a while spaced off the wiring and I found out that they resistor that's completely fried this is 1k resistor here in the parts list they call that a filter resistant it should be 1 watt so if we follow the flow here's the rectifier tube so here's our positive voltage supply for the radio one filter cap here we go up and around through the upper transformer down through that 1k and there is the other filter cap, so I would not be surprised at all if this cap shorted out and took out that resistor obviously this cap has also got some issues here is the one end is blown out I also notice that this 15 ohm resistor is measuring about 4 times higher than it should be, so I'm going to replace that this 10 ohm guy isn't too bad it's a little high but not, not horrible, so these three resistors are all in the power supply a 10 ohm here that and with the pilot light in 15 ohms here feeds the plate and there's a 1k over here for the power supply five filters very typical these All American five radios to have issues with the power supply off on these electrolytic s-- go bad and start causing all kinds of havoc especially because they tended to use cheap electrolytic the steam looks like a mess I can see the bottoms bulging out here it's actually even just a paper still under I don't think it's even that's definitely that metal dual section 30 and 50 both rate 150 volts I pulled out a couple caps to replace it with I got thirty 3 micro farads rated 200 volts and 47 rated for 250 I like to go say at least 50% high on the voltage when I replace caps the 47 sure it's a little less than 50 but not too much to make it a problem plus 30 and replacing with 33, so I'm replacing an 80 total micro farad capacitance capacitor with another 80 micro farad combination, so that should be just fine have not custom tubes yet but that will be coming up five of them altogether as I said it's an All American five let's check the pilot light to just notice that it's completely broken loose not sure works supposed to go starting on that like maybe you could fit in up here's the dial imagine maybe it goes ok I see that's up just as simple as that alright that's cool I hope the audio output transformer is good enough to measure that tubes I don't know that's actually a number...

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Who is required to file california state income tax?

What is the purpose of california state income tax?

How to fill out california state income tax?

What information must be reported on california state income tax?

Where do I find california form 540a?

How do I make edits in ca income without leaving Chrome?

How do I fill out california 540a on an Android device?

What is CA FTB 540A?

Who is required to file CA FTB 540A?

How to fill out CA FTB 540A?

What is the purpose of CA FTB 540A?

What information must be reported on CA FTB 540A?

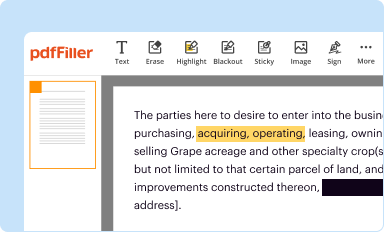

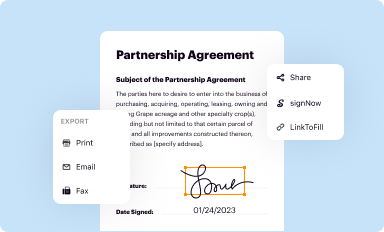

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.